On June 16, 2025, Morgan Stanley, a top investment bank, released an in-depth research report titled China’s Emerging Frontiers: Robotics Unleashed, the Arrival of a New Era. The report comprehensively analyzes the current status, core driving forces, future trends, and comprehensive industrial chain investment opportunities of the global and Chinese robotics markets. It clearly states that with the empowerment of artificial intelligence (AI), a new era led by robotics is accelerating, and China will be the absolute center of this transformation.

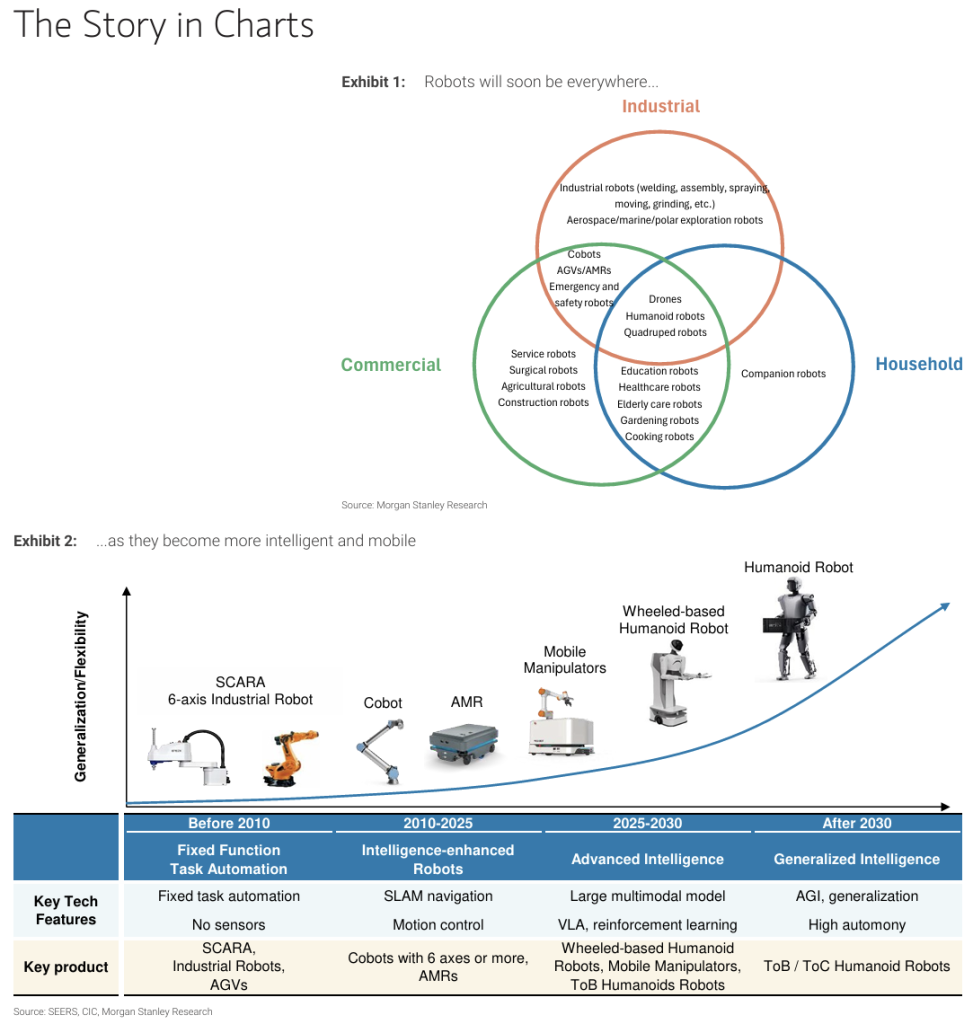

Quick View of the Core Ideas – The Four Pillars of the Robot Revolution

The report explicitly outlines the core logic of the robotics industry in the coming years from the outset.

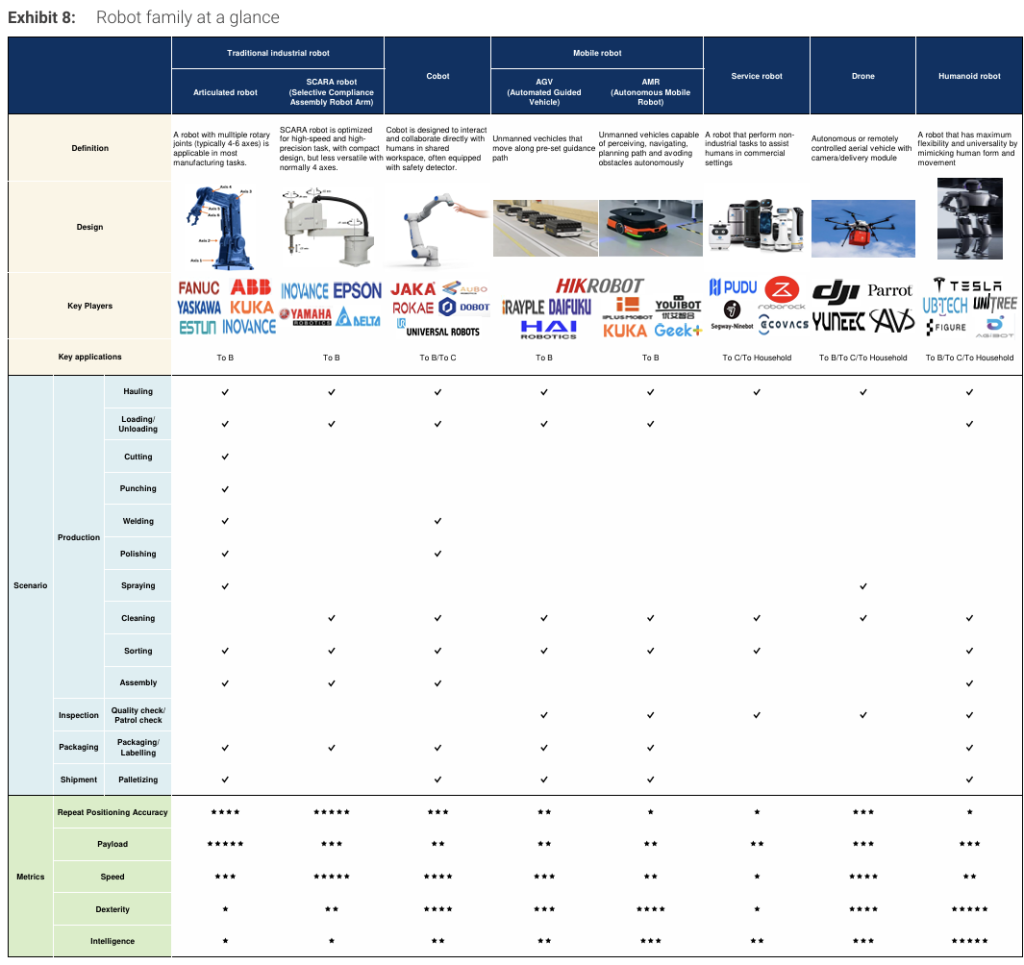

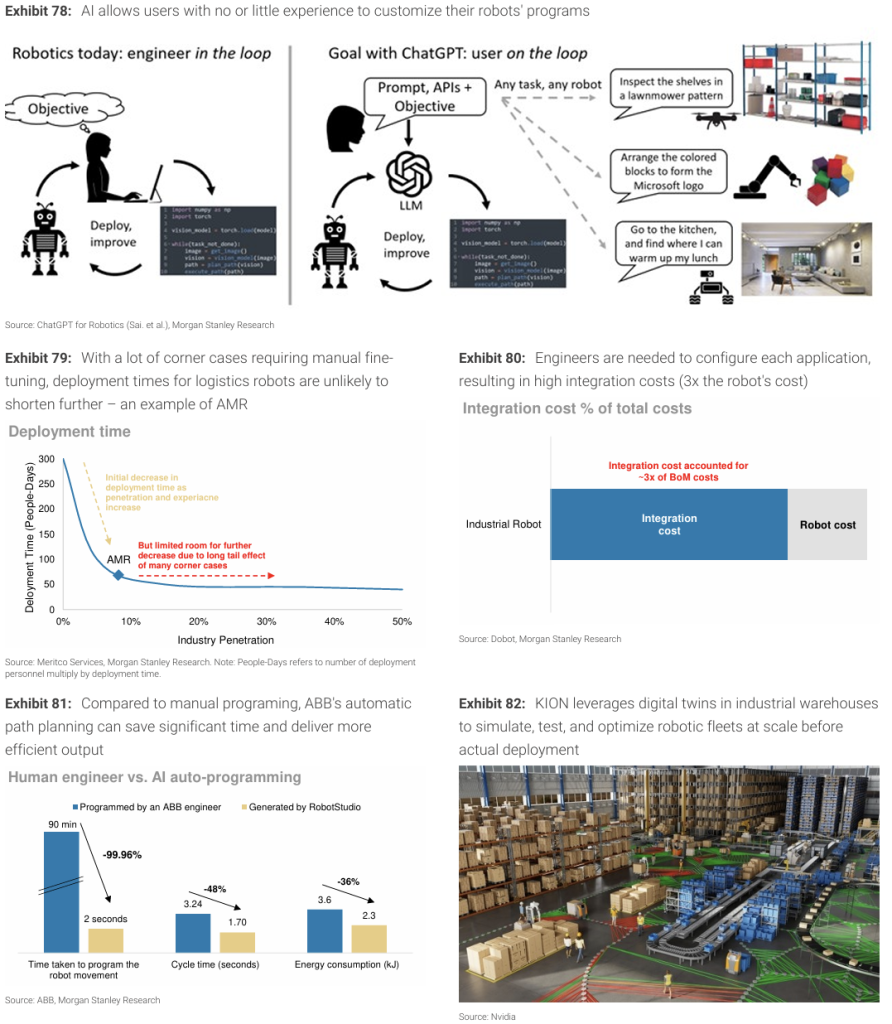

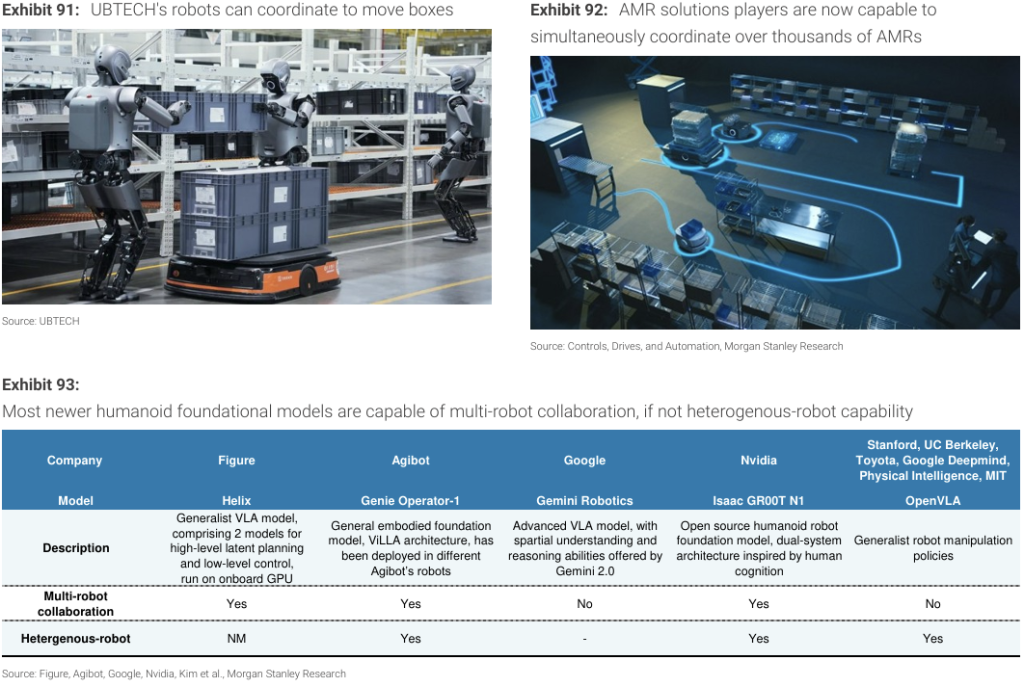

AI Empowerment and Expanded Scenarios: Artificial intelligence technologies are endowing robots with stronger collaboration capabilities and autonomy, unlocking unprecedented application scenarios. Robots are no longer simple automated tools but intelligent agents capable of adapting to dynamic environments.

Doubling Growth in the Chinese Market: The report predicts that the scale of China’s robotics industry will double within the next four years (by 2028). The growth will be led by drones, mobile robots, and collaborative robots (Cobots).

Humanoid Robots as the Ultimate Form: In the long run, humanoid robots will become the largest category of robots and the ultimate carrier of the trillion-yuan market.

Industrial Chain Opportunities and Domestic Substitution: The huge market growth and domestic substitution potential bring historical opportunities to the upstream supply chain. Particular attention should be paid to fields such as sensors, vision systems, motors, and reducers.

Market Vision — China Leading the Global Robotics Market

The report elaborates on the scale and growth potential of the global and Chinese robotics markets.

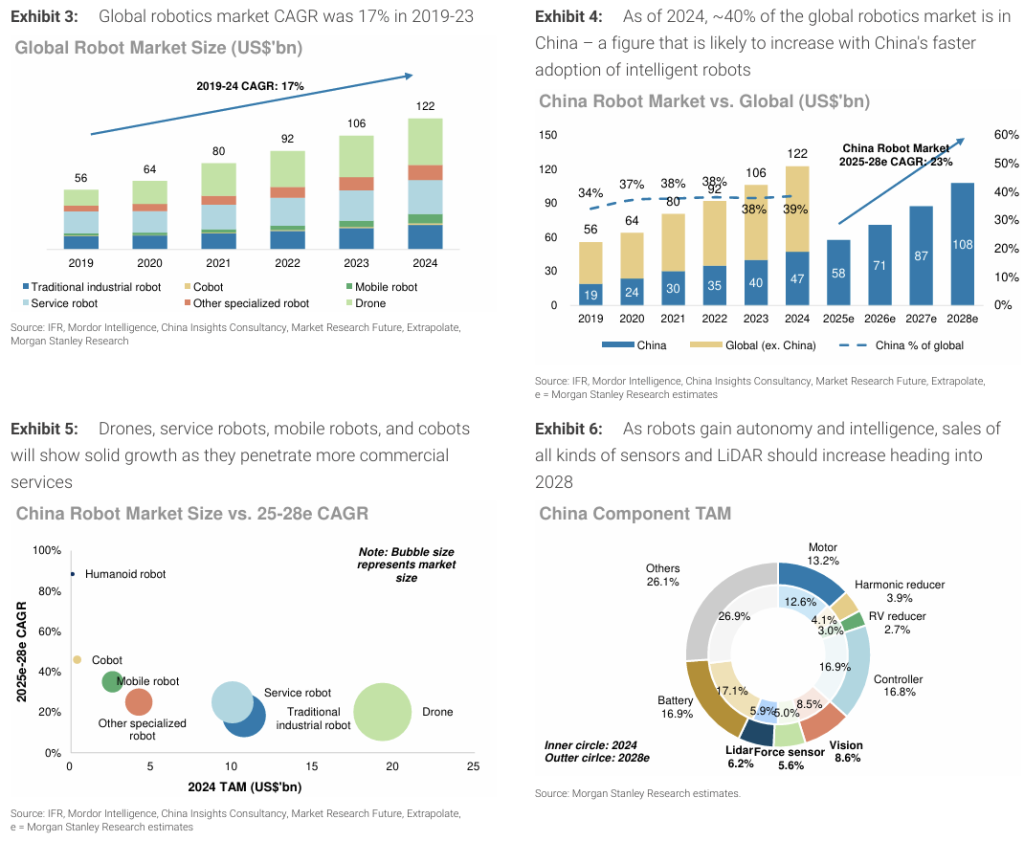

Global Market Overview

The global robotics market experienced a compound annual growth rate (CAGR) of 17% between 2020 and 2024, with its size estimated at $122 billion in 2024. Key drivers of this growth include accelerated industrial automation, global labor shortages, and advancements in AI and machine learning technologies. In terms of market segments, traditional industrial robots, service robots, and drones dominated the market in 2024, accounting for 20%, 25%, and 35% of the share respectively.

China’s Core Position in the Market

China has become the undisputed growth engine of the global robotics market.

Scale and Share: In 2024, the size of China’s robotics market reached approximately $47 billion, accounting for nearly 40% of the global total.

Growth Projections: Morgan Stanley forecasts that from 2025 to 2028, China’s robotics market will achieve a remarkable CAGR of 23%, with its total scale expanding to $108 billion. By then, drones are expected to become the largest segment, accounting for nearly 40% of the market. Collaborative robots, mobile robots, and service robots will witness the most rapid growth, with projected CAGRs of 46%, 35%, and 25% respectively.

Innovation Hub: The report emphasizes that China is not only the largest robotics market but also evolving into a global innovation hub, driving improvements in cost-effectiveness and the development of next-generation robotics technologies.

In-Depth Analysis of Segmented Tracks — The Diverse Robotics Family

The report conducts a detailed analysis of different types of robots, revealing their respective market dynamics and application prospects.

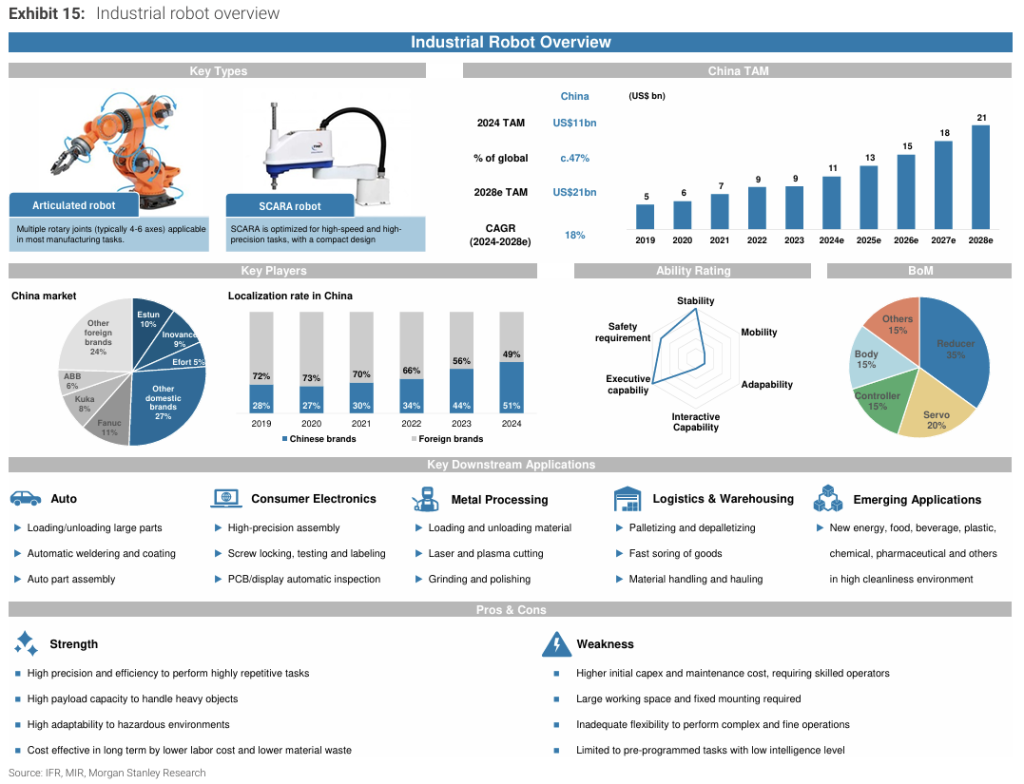

1.Traditional Industrial Robots: The Cornerstone of Automation

Market Size: In 2024, China’s industrial robot market was valued at $11 billion, accounting for approximately 47% of the global market, and is expected to grow to $21 billion by 2028.

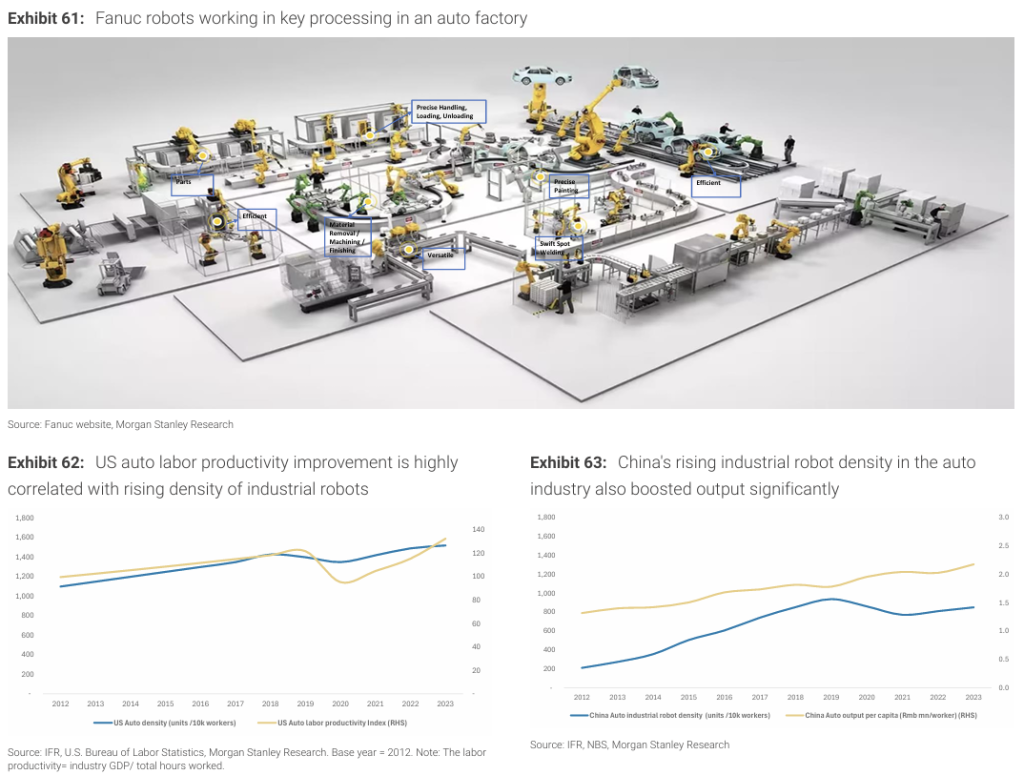

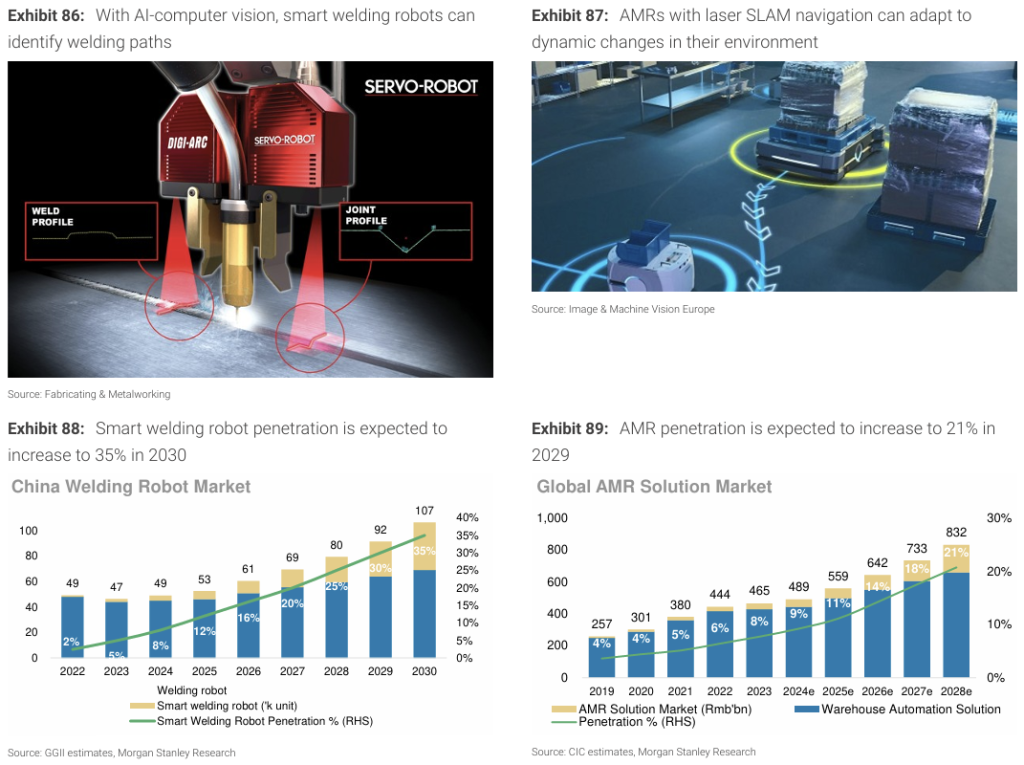

Core Applications: Mainly used for tasks such as material handling, welding, and assembly. The automotive industry is its most important client, accounting for 27% of China’s market share, followed by fast-growing sectors like electronics, metal machinery, new energy, and logistics.

Localization Progress: In 2024, the market share of domestic industrial robots exceeded 50%. However, in the field of high-tech large six-axis robots, the localization rate is about 30%, leaving significant room for improvement.

Technical Characteristics: Their Bill of Materials (BoM) places heavy emphasis on high-precision reducers, high-torque servo systems, and rigid structural components.

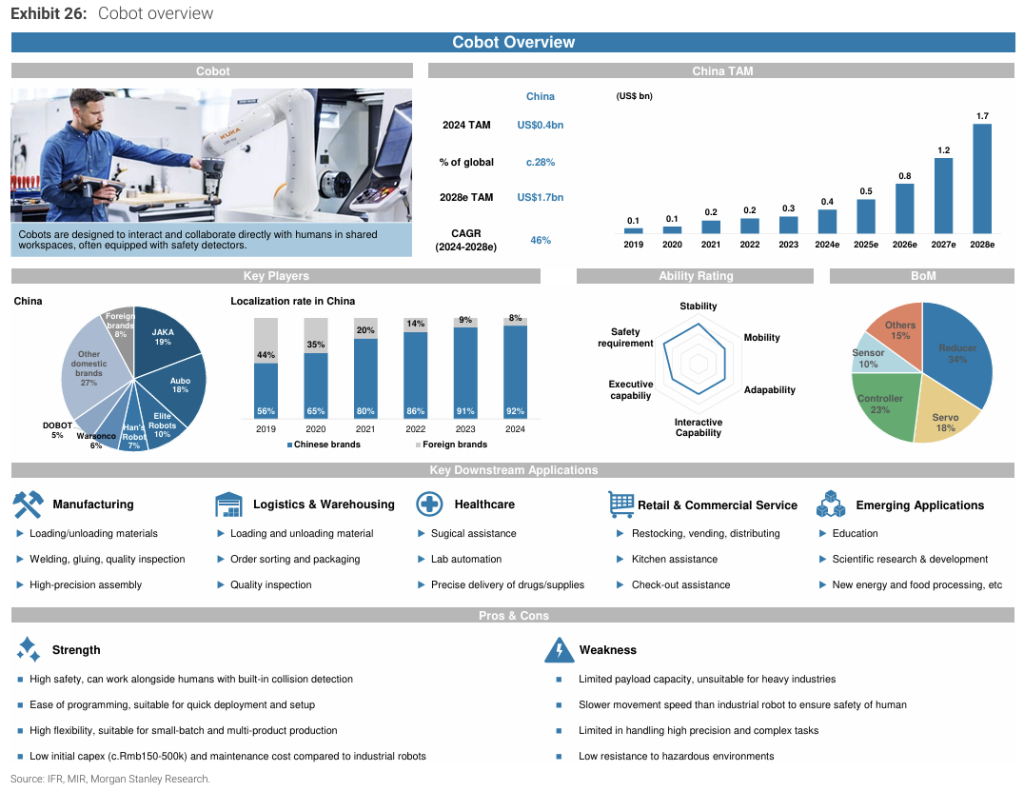

2.Collaborative Robots (Cobot): The Vanguard of Flexible and Safe Growth

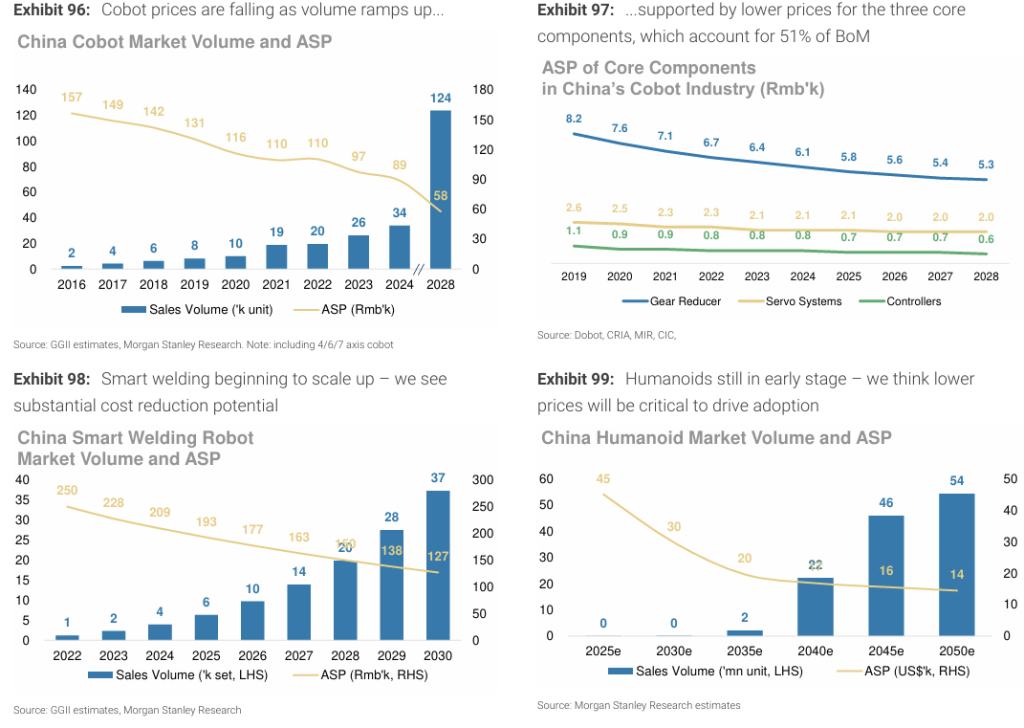

Market Size: One of the fastest-growing categories, China’s market is projected to achieve a CAGR of up to 46% from 2024 to 2028.

Core Applications: Designed for safe collaboration with humans in shared spaces without safety fences. Due to their easy programming, flexible deployment, and low total cost of ownership, they are rapidly penetrating into manufacturing, logistics, healthcare, and even commercial services.

Localization Progress: Chinese brands have taken a dominant position, accounting for over 90% of the domestic market share and more than 60% of the global market.

Technical Characteristics: The BoM (Bill of Materials) places greater emphasis on force/torque sensors, safety-grade controllers, and lightweight materials.

3.Mobile Robots (AGV/AMR): The Core of Intelligent Logistics

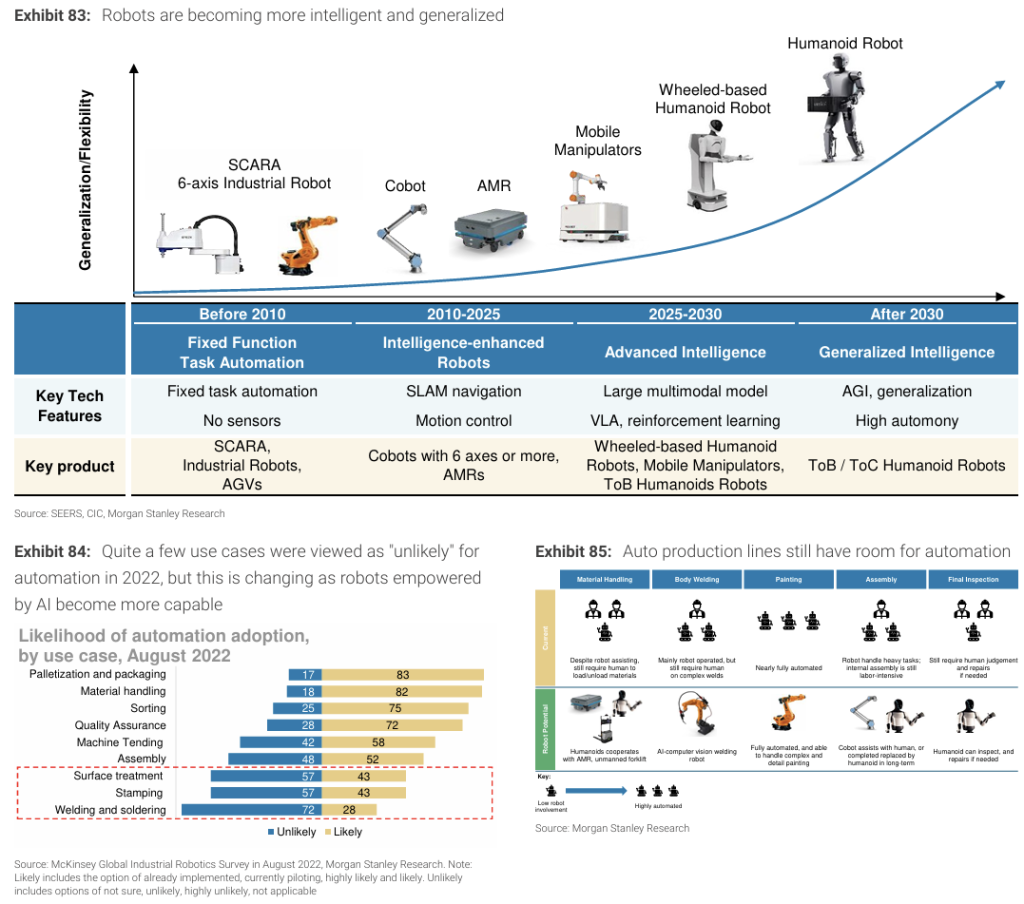

Market Size: The Chinese market is expected to register a CAGR of 35% from 2024 to 2028. Autonomous Mobile Robots (AMRs) are the fastest-growing segment, leveraging navigation technologies like SLAM to enable dynamic path planning and obstacle avoidance without infrastructure modification.

Core Applications: Warehouse logistics represents the largest application scenario, followed by manufacturing sectors such as electronics, photovoltaic, lithium battery, and automotive components.

Localization Progress: The localization rate is extremely high, exceeding 90%. This benefits from domestic brands having no significant technological gap compared to foreign counterparts and their ability to provide customized, cost-effective solutions for complex local application scenarios.

Technical Characteristics: The core of the BoM (Bill of Materials) lies in navigation and perception systems (e.g., LiDAR, cameras, depth sensors), batteries, and drive systems.

4.Service Robots: Penetrating All Aspects of Life and Work

Market Size: The Chinese service robot market is projected to reach $24 billion by 2028, covering professional service, medical, and consumer service robots.

Core Applications:

Commercial sectors like food delivery and hotel services are growing rapidly.

Cleaning robots in household scenarios have become quite mature.

Rehabilitation and surgical robots in the medical field hold huge potential.

Localization Progress: The landscape is “unbalanced”. In household cleaning, food delivery, and similar fields, domestic brands have achieved absolute dominance through cost advantages and customized AI interaction. However, in the field of high-precision medical surgical robots, imports remain relied upon.

5.Drones: Versatile Operators in the Sky

Market Size: By 2028, China’s drone market is expected to reach $40 billion, emerging as the largest segment in the robotics sector.

Core Applications: Divided into military and civilian uses. In civilian domains, industrial/commercial applications (e.g., mapping, agricultural plant protection, inspection, logistics) drive growth, while consumer-level applications focus on aerial photography and entertainment.

Localization Progress: Near 100%. Shenzhen has become the global drone capital, boasting a complete and robust industrial chain cluster.

Technical Characteristics: The BoM (Bill of Materials) centers on flight control systems (chips, GPS, sensors), power systems, and lightweight materials, with battery energy density being critical.

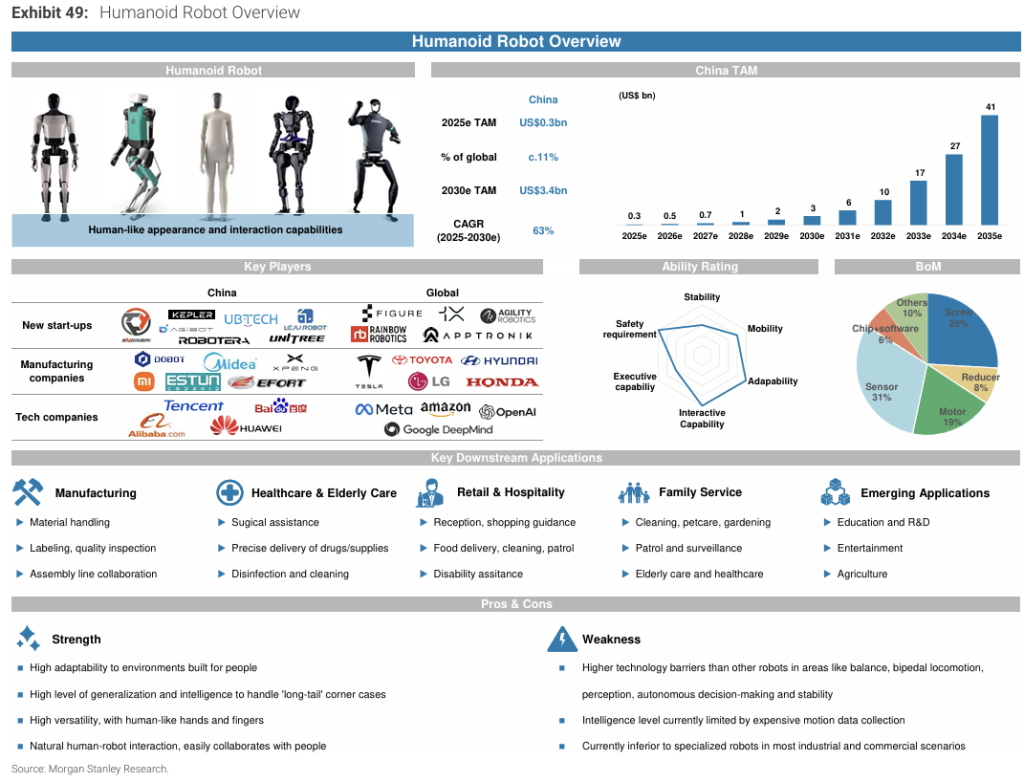

6.Humanoid Robots: The Ultimate Track to the Future

Market Potential: The report boldly predicts that by 2050, the global annual revenue of the humanoid robot market will reach $5 trillion. The Chinese market will be a significant component, with an estimated 300 million humanoid robots by 2050, accounting for 30% of the global total.

Development Stage: 2025 is regarded as the first year of mass production of humanoid robots. Currently, it is still in the early stage, facing technical challenges in balance, movement, perception, and decision-making.

Technical Characteristics: Possessing the most complex BoM (Bill of Materials), it has extremely high requirements for high-power-density actuators, advanced tactile/force sensing, complex balance algorithms, and power distribution systems.

Industrial Chain Opportunities — Tapping into Upstream Core Components

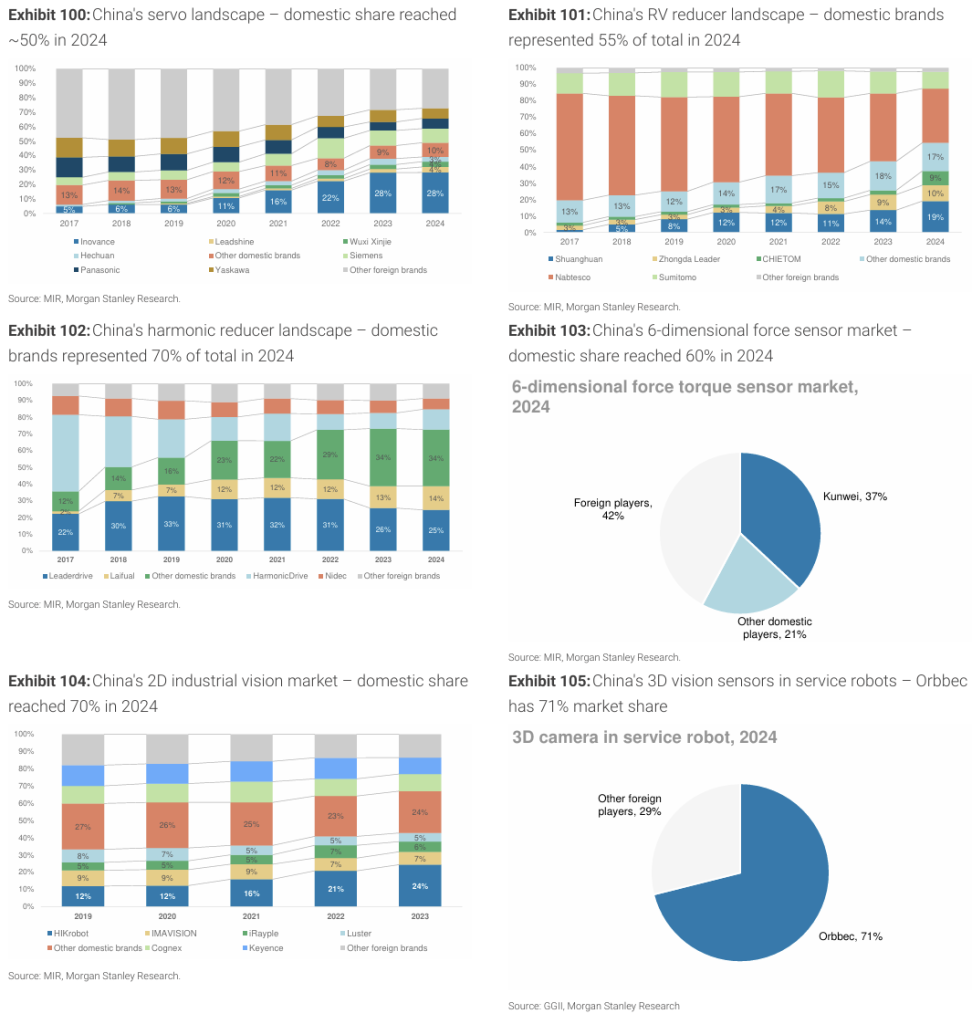

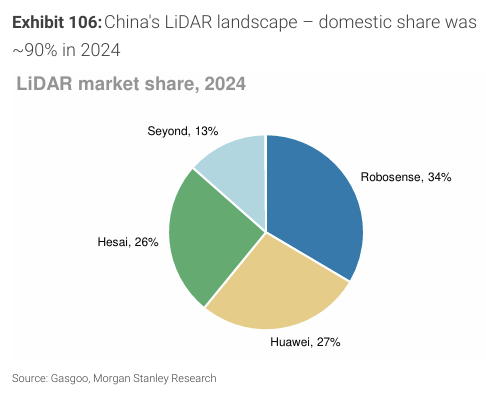

The explosion of the robotics market has brought huge growth space and domestic substitution opportunities for upstream core component suppliers.

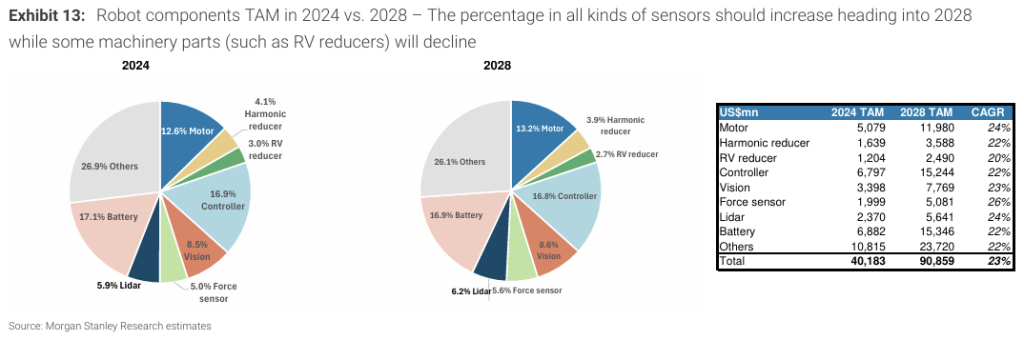

Component Market Size: In 2024, the total addressable market (TAM) for global robotics components was $40 billion, and it is expected to grow at a CAGR of 23% by 2028.

Value Distribution: By 2028, batteries and motors will be the two components with the largest value, accounting for 17.1% and 13.2% of the total BoM (Bill of Materials) cost respectively.

Fastest-Growing Components: With the improvement of robot intelligence, components for autonomous, intelligent, and advanced interaction—especially 3D vision, force sensors, and other types of sensors—will witness the fastest growth.

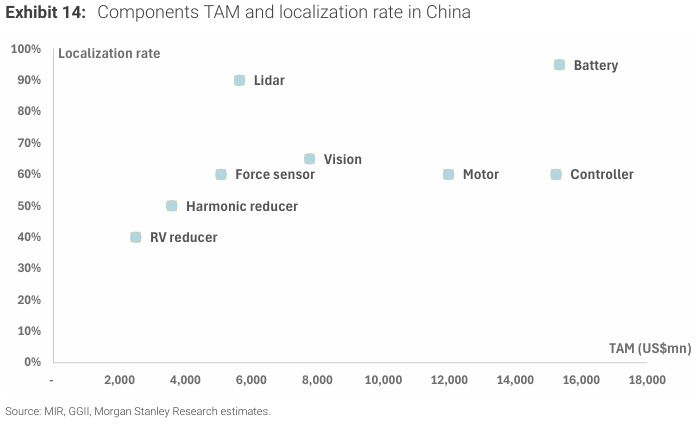

Domestic Landscape: Currently, China has achieved a high localization rate (generally >40%) in various core components, ranked from high to low as: batteries > LiDAR > vision sensors > motors > force sensors > controllers > harmonic reducers > RV reducers.

The Power of Transformation — How Robots Are Reshaping Manufacturing

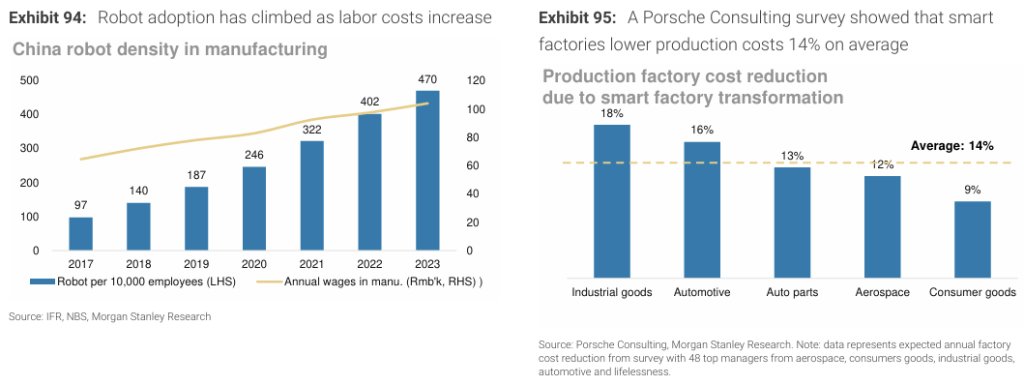

The report demonstrates the disruptive impact of robots on manufacturing through detailed data and cases.

Productivity Enhancement:Research shows that enterprises using robots have labor productivity and total factor productivity (TFP) 30% higher than those without robots. Every doubling of robot density per capita boosts labor productivity by 11% and TFP by 8%.

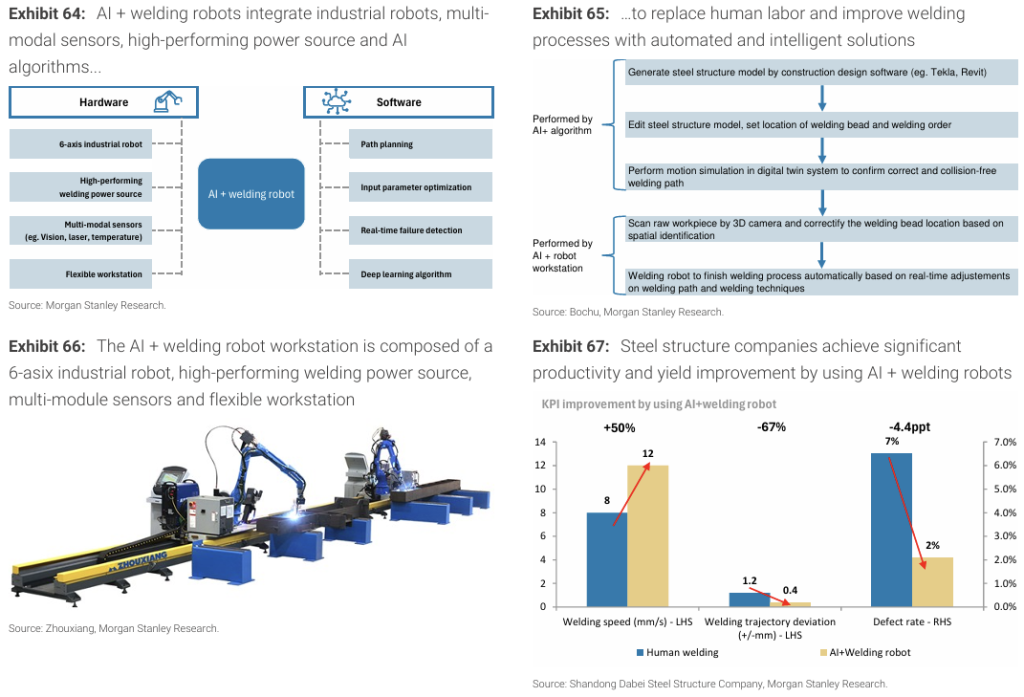

Product Quality Improvement:Robots offer precision far exceeding human capabilities. For example:In automotive welding, robot precision reaches ±0.1mm, compared to ±0.5mm for manual work.In photovoltaic cell production, robots reduce the fragment rate from 0.1% (manual) to 0.02%.

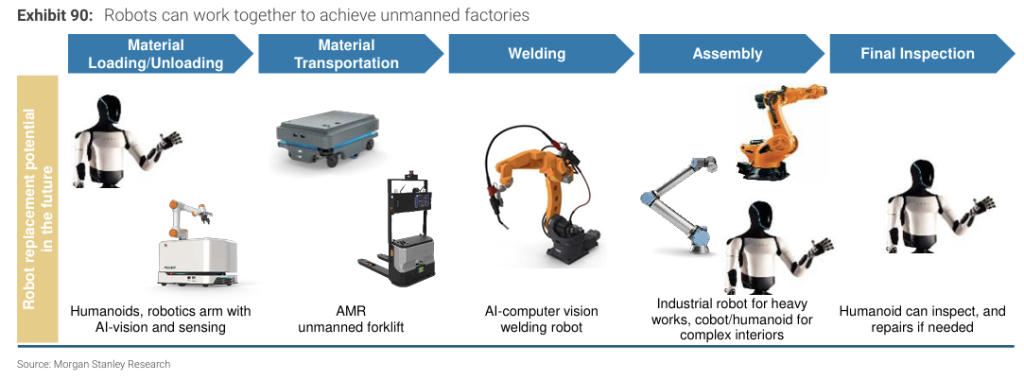

Decision Optimization and Flexibility:Agricultural drones guide precision fertilization using multispectral data.Logistics robots optimize warehouse layouts with real-time data.Collaborative robots enable production line switching within 15 minutes, adapting to “multi-variety, small-batch” manufacturing models.

Industrial Upgrading:The widespread use of robots not only replaces dangerous and repetitive labor but also drives demand for high-value positions like robot engineers and development engineers—thereby elevating overall social labor skills.

Case Studies:The report cites specific cases in automotive, steel, photovoltaic, mining, and agriculture sectors:Tesla’s Shanghai Gigafactory produces a vehicle every 45 seconds.AI welding robots increase welding speed by 50% and reduce defect rates by 4.4 percentage points.DJI drones enable single-person management of 100-mu orchards, boosting yields by 25%.

Future Outlook — Three Trends Leading the Robotics Revolution

The report concludes by envisioning three core trends shaping the future of the robotics industry.

AI Lowering Application Thresholds:The emergence of “no-code” programming and Large Language Models (LLMs) enables non-professional engineers to quickly deploy and debug robots, significantly reducing usage barriers and integration costs. Digital Twin technology allows optimization and testing of production processes in the virtual world, minimizing real-world deployment time and resource waste.

Robot Collaborative Operations:Future factories will be dominated by robot “teams” working in tandem. Through advanced AI algorithms and perception systems, robot fleets (such as AMR convoys or humanoid robot squads) can autonomously schedule, coordinate tasks, and avoid collisions, achieving unprecedented operational efficiency. Different types of robots (e.g., humanoid robots and mobile robots) can also complement each other’s strengths and work collaboratively.

Sustained Cost Reduction:From collaborative robots to intelligent welding robots and future humanoid robots, the report observes a clear trend: with technological maturity, scaled production, and intensified competition, the average selling price (ASP) of robots will continue to decline. This will further shorten the return on investment cycle, driving the popularization of robots in more industries and scenarios.

Appendix – Landscape of China’s Core Robotics Components