Preface: The Double Helix of Industrial Iteration and Capital Rotation Once Again Unfolds a Striking Historical Rhythm in the Robotics Field.

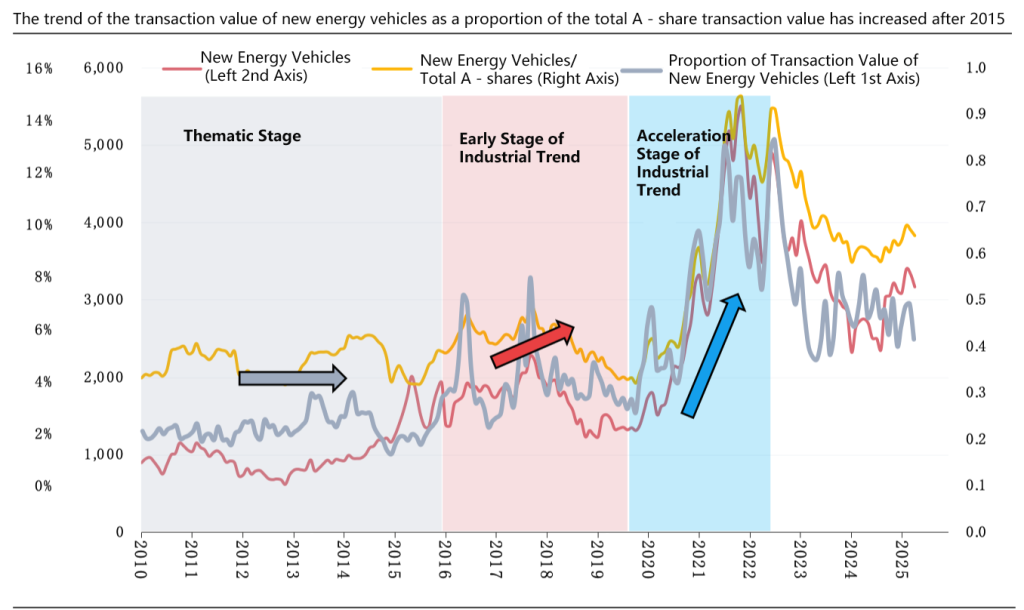

In early 2025, Unitree Technology’s G1 humanoid robot went on sale to consumers via JD.com and Taobao at a price of 99,000 RMB—and sold out within a day, with daily rental prices in Beijing skyrocketing to 10,000 RMB. Meanwhile, Tesla’s Optimus humanoid robot plans to produce 5,000 units annually and announced a 10-fold capacity increase by 2026. This scenario evokes memories of 2014 in the new energy vehicle (NEV) sector, when “Wei Xiaoli” (NIO, XPeng, Li Auto) emerged, Tesla launched mass production of the Model S, and capital frenziedly chased new automotive startups.

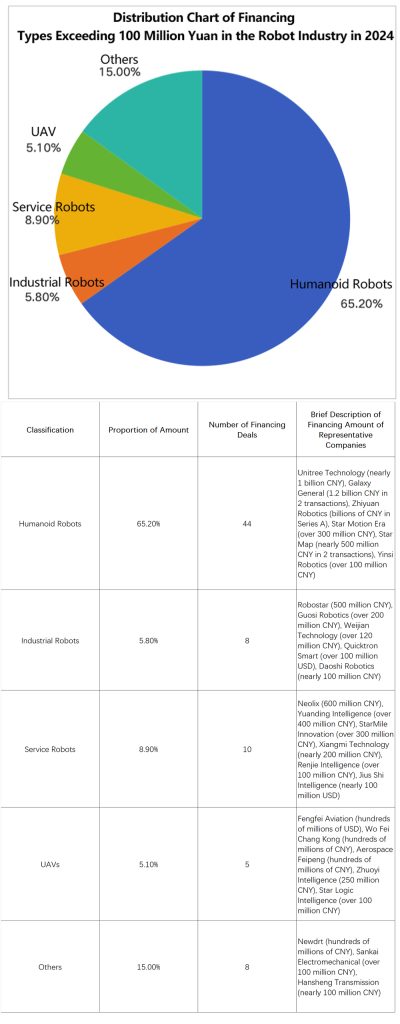

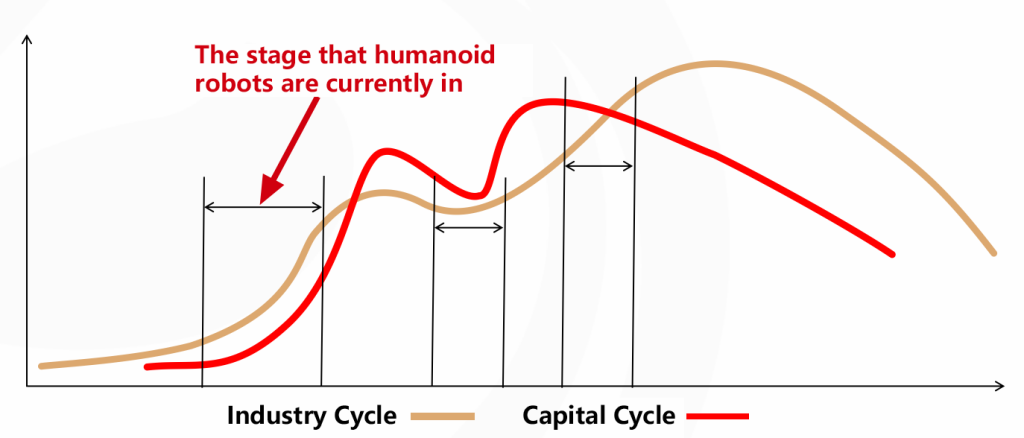

The double helix of industry and capital has already played out a complete cyclical rhythm in the NEV sector: from policy nurturing in the embryonic stage to capital revelry during the subsidy dividend period, and then to value reconstruction in the intelligentization era—two curves interweaving and evolving. As we examine the current upsurge in the humanoid robotics industry—with global financing reaching 18.65 billion RMB in the first five months of 2025, exceeding the total for all of last year, and domestic financing hitting 6.1 billion RMB with the number of enterprises surging 44% year-on-year—this mirrors the historical juncture of NEVs on the eve of their subsidy dividend period in 2014.

Article Table of Contents:

A Retrospective: The Dual-Cycle Evolution Map of New Energy Vehicles

Current Position: The Stage of Humanoid Robots

Points of Divergence: Unique Challenges Facing Humanoid Robots

The Next Decade: Advancement Path Driven by Dual Cycles

Critical Reflection: How Long Can the Capital Boom Last?

1.The Path of Retrospection: The Dual-Cycle Evolution Map of New Energy Vehicles

The new energy vehicle industry has completed a full cycle of industrial and capital development, providing a reference for the robotics industry:

Embryonic Stage (Pre-2009): Technological Exploration vs. Cautious Capital

When BYD entered the automotive sector in 2003, primary market investments were limited to government research funds and tentative VC (trial entries). Hybrid and early pure electric technologies remained in the laboratory, with no independent secondary market track formed.

Though technological accumulation during this period did not trigger market explosion, it sowed the seeds of an industrial revolution.

Policy-Driven Period (2009–2013): First Dual-Cycle Resonance

China’s “Ten Cities, Thousand Vehicles” plan ignited the industrialization engine, with electric bus fleets hitting the streets.

Capital responded swiftly: CATL was founded in 2011 to focus on NCM battery R&D, while BYD launched its first pure EV e6 in 2010, entering the secondary market. Government subsidies became the key link between industrial demand and capital supply.

Subsidy Dividend Period (2014–2017): Capital Frenzy Sweeps the Industry Chain

The primary market saw a financing boom for “Wei Xiaoli” (NIO, XPeng, Li Auto), with Sequoia and Hillhouse making heavy bets; the secondary market witnessed the market cap myth brought by Tesla’s Model S mass production.

Technological breakthroughs in NCM batteries enabled range to cross the 300-km threshold, with charging networks expanding synchronously. CATL’s 2018 listing as the global battery leader marked capital’s value recognition of core components.

Accumulation & Globalization Period (2018–2021): Dual Cycles Undergo Stress Tests

Subsidy withdrawal triggered industry reshuffling, with capital concentrating on leading players—Tesla’s market cap exceeded $1 trillion in 2020, and BYD’s Blade Battery mass production reshaped technical standards.

The industry upgraded amid (growing pains): CTP technology reduced battery costs, with China accounting for over 60% of global production. SVOLT Energy’s $10 billion financing in 2021 confirmed capital’s persistent pursuit of technological breakthroughs.

Maturity & Intelligence Period (2022–Present): Differentiation (Main Theme)

Electrification penetration exceeds 30%, with competition focusing on intelligence. The capital market has stratified accordingly:

BYD surpassed Tesla in sales relying on vertical integration advantages.

Primary market funds have flocked to frontiers like lidar and autonomous driving—Hesai Technology’s monthly lidar deliveries exceeding 100,000 units highlight the value of intelligent supply chains.

2.Current Position: The 2014 Moment for Humanoid Robots

Standing in 2025, the humanoid robot industry shows striking similarities to the new energy vehicle sector in 2014:

Standing in 2025, the humanoid robot industry shows striking similarities to the new energy vehicle sector in 2014:

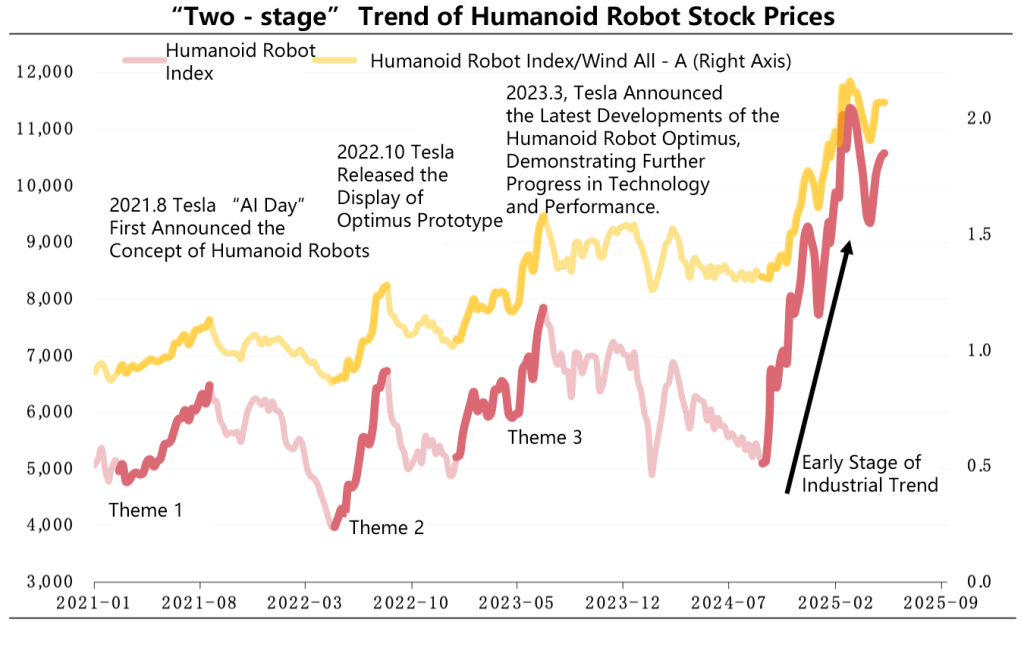

Capital Cycle: Frenzy of Thematic Investment

Primary Market Frenzy: The primary market has entered a white-hot phase of “project grabbing”. Global humanoid robot financing reached 18.65 billion RMB in 2025, a 44% increase over the entire 2024; domestic financing hit 6.1 billion RMB, exceeding the full-year 2024 total. This capital fever mirrors the 2014 financing boom for “Wei Xiaoli” (NIO, XPeng, Li Auto)—when the three new players raised over $2 billion in a year, with institutions vying to bet on the electrified future.

Emerging Valuation Bubbles: Valuations of some (body) enterprises have doubled in six months, and PS valuations of core component companies have exceeded 20x. With technical routes yet to converge and mass production nowhere in sight, valuation overdrafts across segments are severe. This irrational exuberance is identical to the 2016 hype of NEV concept stocks, which saw secondary market indices drop 40% within a year after short-term 5–10x growth, prematurely exhausting industry growth expectations.

Industrial Cycle: Hard Fought on the Eve of Mass Production

Clusters of Technical Breakthroughs: 2025 saw multiple global firsts in Chinese humanoid robots—”Tiangong” robots completed 134 consecutive outdoor stair climbs; Zhongqing robots achieved front-flip stunts; breakthroughs in autonomous standing control enabled robots to stabilize on slopes, soft cushions, and other complex terrains. These advancements mirror the 2014 breakthrough of NCM battery energy density exceeding 180Wh/kg, clearing obstacles for scaled applications.

Cost Reduction Drives Commercialization: Unitree Technology has pulled full-size humanoid robot prices to the 99,000 RMB range—just 1/7 the cost of Boston Dynamics’ Spot. China’s supply chain advantages are replicating CATL’s cost reduction path—by self-developing basic components like joint modules, motors, gears, and bearings, Youliqi claims costs 70% lower than the industry, analogous to CATL reducing battery pack costs by 30% via CTP technology.

Countdown to Mass Production: Tesla plans to produce 5,000 Optimus units in 2025, ramping to 50,000 in 2026; UBtech’s Walker S series has secured over 500 orders; Zhiyuan Robotics has rolled out 1,000 units with a 2025 target of 3,000–5,000. This parallels Tesla’s 2014 Model S annual production of 35,000 units, declaring electric vehicles were no longer lab toys.

3.Points of Divergence: Unique Challenges Facing Humanoid Robots

The technical route has not yet converged.

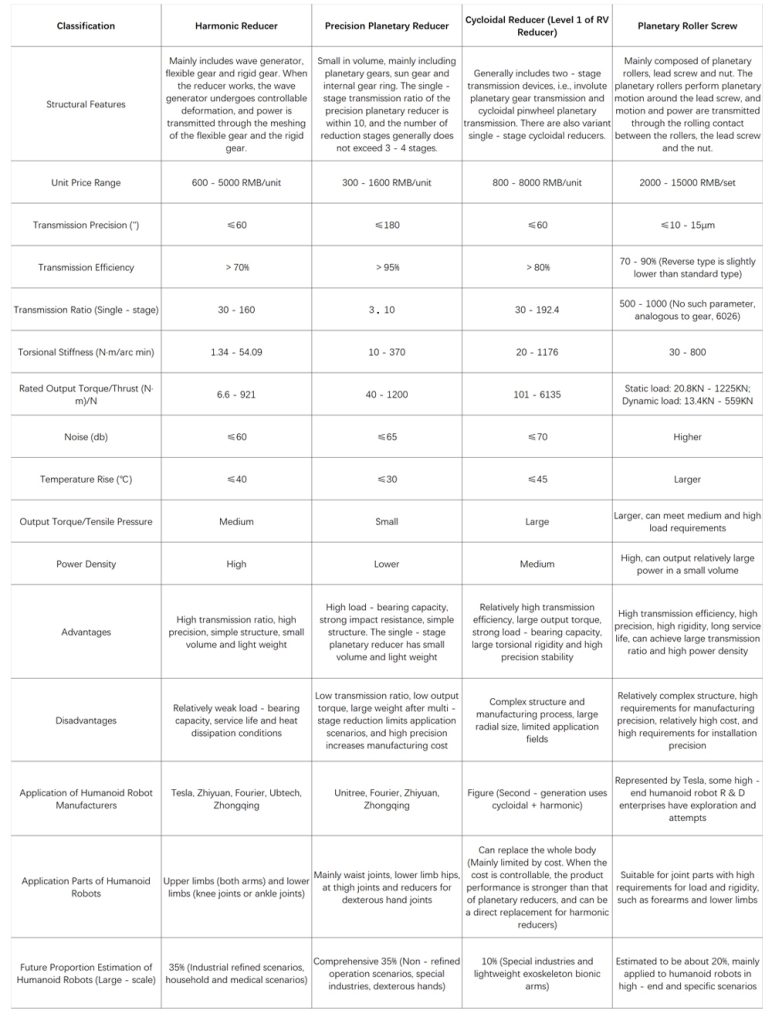

New energy vehicles (NEVs) had formed a standardized architecture of “battery + motor + electronic control” by 2014, while the hardware form of humanoid robots is still in an era of fierce competition. For joint modules, there are multiple competing technical routes, including planetary gear reducers, planetary roller screws, harmonic reducers, and cycloidal pinwheel reducers. In sensing solutions, the unit price of six-dimensional force sensors still exceeds 10,000 yuan, and tactile sensors have not yet solved the problem of low-volume engineering mass production. Professor Mu Yao from Shanghai Jiao Tong University pointed out: “Existing solutions struggle to replicate the fine manipulation perception capabilities of the human hand.” This technical fragmentation is significantly higher than that of NEVs at the same development stage.

Data ecology urgently needs breakthroughs. Different from new energy vehicles that naturally accumulate data through actual driving, humanoid robots are stuck in a “data dilemma”: high-precision equipment is required to collect data in industrial scenarios, keeping costs high; users in household scenarios hardly accept the “learning while using” mode. You Wei, Chairman of EFORT, frankly stated that “the key to landing applications lies in autonomous intelligence, which requires high-quality data for training”. The solution of Youliqi is quite enlightening – collecting data through humans wearing tactile sensors to train multimodal models, enabling robots to obtain tactile prior knowledge, but this solution is still in the early verification stage.

Application scenarios are more fragmented. In the early stage, new energy vehicles focused on the single scenario of private passenger cars, while humanoid robots need to overcome scattered scenario islands: in industrial scenarios, Tuosida aims at flexible production line sorting; Yunshenchu deepens special industry inspection; in the power field, the “Tiangong” robot has been able to operate 245 bus coupler cabinets. This fragmentation leads to the delay of scale effect, just as He Xiaopeng of XPeng Motors said: “Humanoid robots need to reach the L4 stage to enter thousands of households, and currently only at the L2-L3 level”.

4.The Next Decade: Advancement Path Driven by Dual Cycles

Based on the development experience of new energy vehicles, the humanoid robot industry may present a three-stage transition:

2025-2027: Mass Production Verification Period (analogous to NEVs 2014-2016)

Capital focus: The primary market tilts toward core components such as robot brains, sensing modules (tactile sensors, force sensors) and dexterous hands, while the secondary market awaits Tesla and domestic leading chain enterprises to run through vertical segmented scenarios to achieve large-scale mass production;

Industrial key task: Cost control and stable and easy-to-use products become the lifeline, which will be tested by the market.

Policy escort: Shenzhen, Shanghai and other places replicate the new energy vehicle “first set” subsidy policy to reduce enterprise trial and error costs and guide industrial collaboration to promote product landing verification and rapid iteration;

2028-2030: Scenario Explosion Period (analogous to NEVs 2017-2020)

Technical convergence: 2-3 mainstream hardware solutions take shape, and Tesla, Huawei, NVIDIA, etc. build basic model ecosystems on the software side Cost inflection point: If joint module costs drop by 80% (current planetary roller screw modules still cost over 10,000 yuan per unit), household service robots will reach the critical price point of 30,000 yuan.

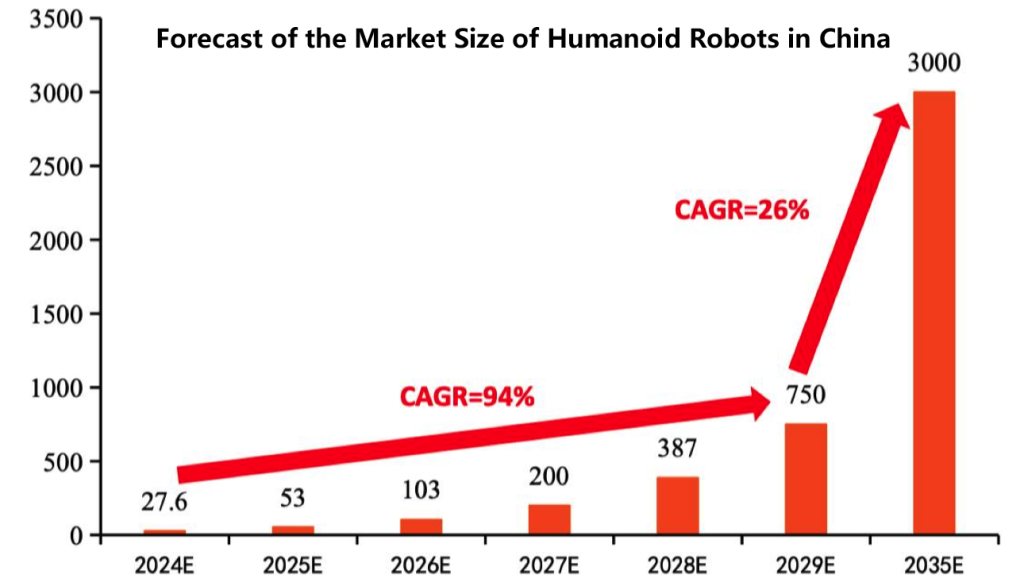

Scenario penetration: The China Academy of Information and Communications Technology predicts large-scale implementation in industrial scenarios by 2035, with the market size reaching 50-300 billion yuan.

2030 onwards: Ecological Competition Period (analogous to NEVs since 2022)

Global landscape: Chinese and American enterprises dominate technical standards and the landing of humanoid robot applications .

Value reconstruction: Shift from hardware sales to the “Robot as a Service” (RaaS) model, with robot brain companies and data assets becoming the core of valuation.

Ultimate vision: Musk plans to send Optimus to Mars in 2029, opening up human space application.

5.Critical Reflection: How Long Can the Capital Boom Last?

From an investment perspective, how to track and grasp inflection point signals in primary and secondary markets?

Valuation Signals: If valuations of leading chain companies and core component enterprises fail to rise, or overall financing activity stagnates/drops due to failed transactions, or multiple M&A exits become predominant.

Industrial Progress Signals: By the end of 2025, Tesla (the leading chain company) fails to achieve 5,000-unit order shipments for large-scale factory applications, or domestic leaders like Zhiyuan, Unitree, and UBtech fail to meet annual revenue/sales targets.

Policy Signals: New local industrial fund scales for robotics decline year-on-year, and national subsidy support for robots significantly cools.

Technological Development Signals: As advanced AI agents, whether humanoid robots can enhance large-model generalization capabilities through data accumulation and algorithm optimization, leading to mass applications in similar scenarios.

History does not repeat itself, but it rhymes.

Boston Dynamics’ Atlas robot learns to fold shirts with the support of Toyota Research Institute’s large behavioral models.

Middle Eastern sovereign funds quietly lay out China’s robotics industry chain—these scenarios form the three-dimensional landscape of humanoid robotics’ industrial and capital resonance in 2025.

Compared with new energy vehicles, humanoid robots have higher technical barriers and more fragmented scenarios, so their capital cycles may exhibit “multiple peaks”: after industrial scenarios break through hundreds of thousands of unit sales in 2028, it will take 5–8 years for household scenarios to truly explode. This requires capital to be more patient, as revealed by the collaboration between Toyota Research Institute and Boston Dynamics—”there is no shortcut to commercializing basic research”.

In the next three years, with Optimus mass production delivery and the iteration of embodied intelligence large models by domestic leading humanoid robot companies, industry chain values will be reshaped amid differentiation. Enterprises that technological essence amid capital frenzy and find their ecological niche in fragmented scenarios will ultimately become the biggest winners of this humanoid revolution. When the industry crosses from “moving and seeing” to a new stage of “thinking and working”, the ultimate picture of human productivity liberation will slowly unfold.